36+ what percent of income for mortgage

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web According to this rule a maximum of 28 of ones gross monthly income should be spent on housing expenses and no more than 36 on total debt service.

What Percentage Of Income Should Go To Mortgage Morty

Estimate your monthly mortgage payment.

. Ad Compare More Than Just Rates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The 36 should include your monthly mortgage payment.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Web Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Find A Lender That Offers Great Service. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Comparisons Trusted by 55000000.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad See how much house you can afford. Check Your Official Eligibility Today.

Determining your monthly mortgage payment. Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

So if your gross. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

Get an idea of your estimated payments or loan possibilities. Ad Compare More Than Just Rates. Save Real Money Today.

Ad Calculate Your Payment with 0 Down. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Compare Lenders And Find Out Which One Suits You Best.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Ad 5 Best House Loan Lenders Compared Reviewed. John in the above example makes.

Most lenders look for a ratio of 36 or less although. Estimate your monthly mortgage payment. With that your other monthly debt should fit in under the overarching cap of 36.

Updated FHA Loan Requirements for 2023. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Find A Lender That Offers Great Service.

Looking For a House Loan. Multiply that by 100 to get a. Web What Percentage Of My Income Should Go To Mortgage Forbes Advisor How Much Of My Income Should Go Towards A Mortgage Payment How Much House Can You Afford.

Web Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income. Ad See how much house you can afford. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Ad Take the First Step Towards Your Dream Home See If You Qualify. Try our mortgage calculator.

Mjd4luowjomtxm

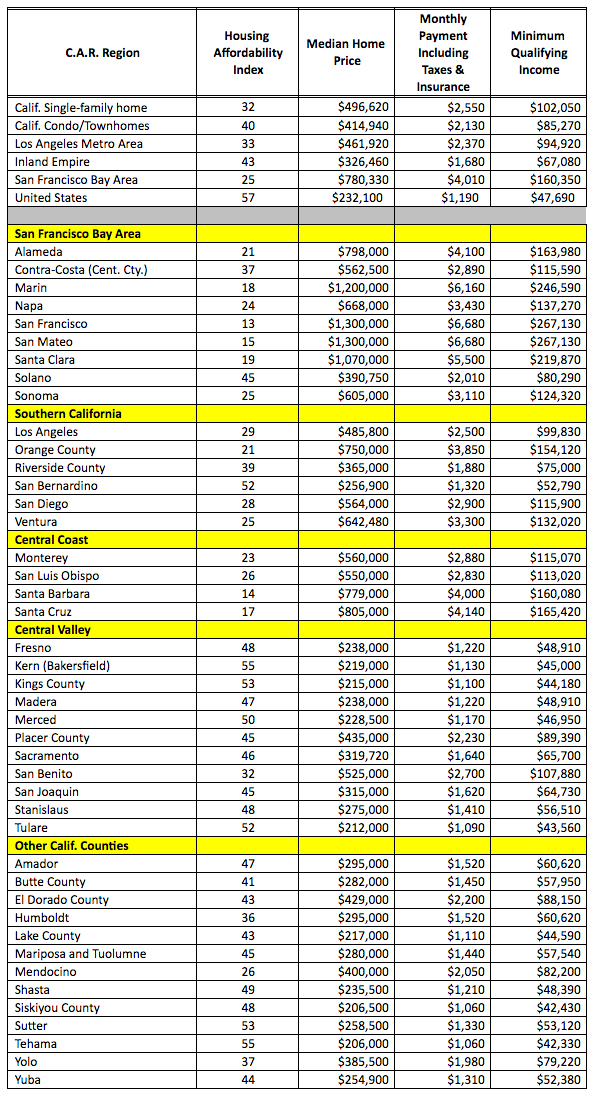

The Income Required To Qualify For A Mortgage The New York Times

The Minimum Qualifying Income Required To Purchase A House

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much House Can You Afford The 28 36 Rule Will Help You Decide

What Percentage Of Income Should Go To A Mortgage Bankrate

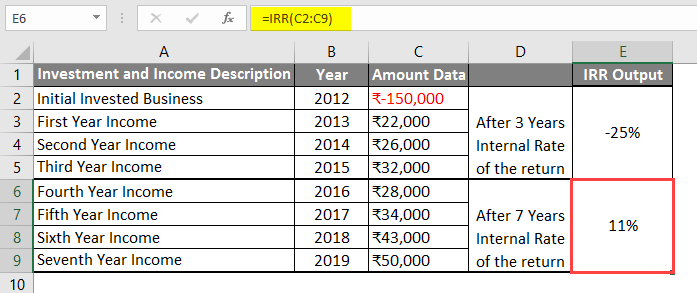

Excel Irr Formula How To Use Excel Irr Formula

How Can People Afford 36 Of Their Gross Income On Mortgage Payments R Personalfinance

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Cities With The Highest Share Of Income Going Towards Mortgage Payments Hireahelper

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How To Get A Mortgage When You Re Self Employed

What Percentage Of Your Income To Spend On A Mortgage

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

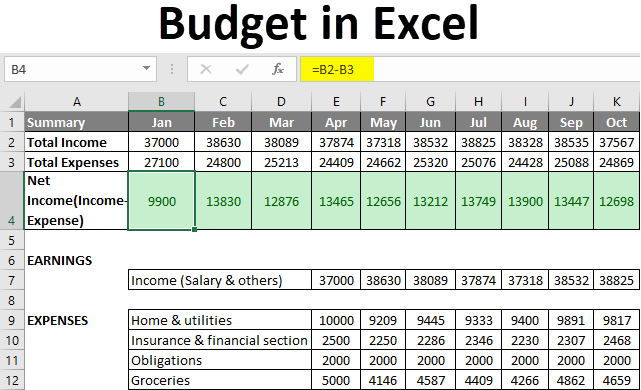

Budget In Excel How To Create A Family Budget Planner In Excel

Presentation Htm

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire